Avalanche (AVAX) has been one of the most promising Layer-1 blockchain projects in the crypto ecosystem. With its high throughput, low transaction fees, and a growing DeFi ecosystem, AVAX has consistently attracted investors looking for alternatives to Ethereum. After experiencing significant volatility in 2024, the question now is: can AVAX reach $50 in the coming months?

Current AVAX Market Overview

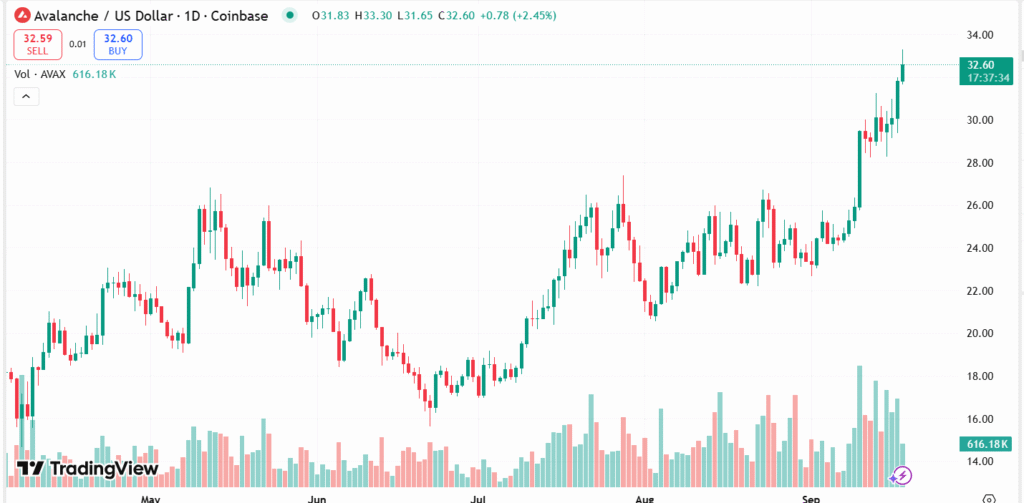

As of September 18, 2025, AVAX is trading in a consolidation zone after strong upward momentum earlier this year. The token has seen increased trading volumes across centralized and decentralized exchanges, signaling renewed investor interest.

Price: $32.61 – $32.75

Market Cap: ~$13.7 – $13.8 billion

Circulating Supply: ~422.28 million AVAX

Max Supply: ~715.75 million AVAX

24h Trading Volume: ~$1.65 billion

24h Price Change: +~10%

The growing number of decentralized applications (dApps) on Avalanche, along with rising institutional interest, has placed AVAX in a favorable position.

For readers who want to stay updated on crypto developments, check out our Crypto News section where we cover real-time market updates.

Key Technical Analysis

Resistance and Support Levels

On the daily chart, AVAX has established strong support around the $30 zone, while the next major resistance lies near $45. If the bulls manage to flip $45 into support, the $50 target becomes highly probable.

Support Levels: $30, $28

Resistance Levels: $45, $50

Moving Averages

AVAX is currently trading above the 50-day moving average (MA), which indicates bullish momentum. The 200-day MA is also trending upward, strengthening the long-term bullish case.

RSI & MACD Indicators

RSI (Relative Strength Index) is hovering around 60, suggesting AVAX is not yet overbought and has room for further upside.

MACD shows bullish crossover, reinforcing positive momentum.

Fundamental Drivers for AVAX

Several factors support the possibility of AVAX hitting $50:

- DeFi Expansion: Avalanche continues to attract DeFi protocols due to its scalability and near-instant finality.

- NFT and Gaming Growth: With NFTs and blockchain gaming migrating from Ethereum due to high gas fees, Avalanche stands as a natural alternative.

- Institutional Adoption: Partnerships with traditional finance players are increasing AVAX’s visibility and credibility.

- Tokenomics: AVAX’s capped supply and burning mechanism create a deflationary effect, potentially boosting long-term value.

For more insights into how emerging technologies like AI influence blockchain development, visit our AI Education hub.

AVAX Price Prediction for 2025

Short-Term (3–6 Months)

If current bullish momentum continues, AVAX could test the $45–$50 resistance range by year-end. A sustained breakout above $50 would open the door to new highs.

Mid-Term (6–12 Months)

With steady ecosystem growth and favorable market sentiment, analysts expect AVAX to trade in the $55–$70 range, provided Bitcoin maintains its bullish trajectory.

Long-Term (2–3 Years)

If Avalanche secures more institutional partnerships and DeFi adoption, AVAX could potentially surpass $100. However, long-term predictions depend heavily on macroeconomic conditions, regulatory shifts, and competition from Ethereum, Solana, and emerging chains.

Risk Factors to Consider

No price prediction is complete without analyzing risks:

Regulatory Uncertainty: Potential U.S. or EU regulations could limit Avalanche’s growth.

Competition: Solana, Cardano, and Polkadot remain strong competitors in the Layer-1 race.

Market Sentiment: A sudden Bitcoin correction could drag AVAX below key support levels.

Technology Risks: Any network congestion or exploits could hurt investor confidence.

For those looking for alternative ways to generate passive income during market uncertainty, check out our Survey Reviews section for non-crypto earning opportunities.

Should You Buy AVAX Now?

For investors with a medium-to-long-term outlook, AVAX presents an attractive opportunity given its strong fundamentals and ecosystem growth. However, short-term traders should monitor resistance around $45–$50 carefully.

Dollar-cost averaging (DCA) could be a smart strategy to mitigate volatility while maintaining exposure to potential upside.

FAQs on AVAX Price Prediction

- Can AVAX reach $50 in 2025?

Yes, based on technical indicators and fundamental growth, AVAX has a realistic chance of reaching $50 within the next few months. - Is Avalanche a better investment than Solana?

Both have strengths: Avalanche excels in finality and scalability, while Solana offers speed. Choosing between them depends on risk appetite and portfolio diversification. - What factors influence AVAX price the most?

Market sentiment, Bitcoin’s price trend, DeFi/NFT adoption, and institutional partnerships are the key drivers. - Should I hold AVAX for the long term?

If you believe in Layer-1 competition and Avalanche’s technological edge, holding long-term may prove beneficial. - Where can I learn more about blockchain and AI trends?

Visit our AI Education hub for resources on how artificial intelligence intersects with blockchain innovation.

AVAX remains one of the most exciting Layer-1 projects, combining speed, security, and scalability. While risks remain, the $50 price target is within reach if bullish momentum continues.

For readers seeking continuous updates, remember to check our Crypto News section. For those exploring alternative income streams, explore our Survey Reviews. And if you’re curious about the intersection of blockchain and AI, our AI Education hub has you covered.

AVAX may not just be on track for $50—it could be setting the stage for an even bigger breakout in the years to come.