In today’s digital world, investing has become more accessible than ever before. Many people still believe that investing in stocks or mutual funds requires a lot of money, but that’s no longer the case. With apps like Optimus by Afrinvest, you can now start investing with as little as ₦100. This guide will walk you through everything you need to know about using the Optimus app to invest smartly and start building your wealth, even if you have less than ₦3,000.

The goal of this article is to show you that investing is not just for the wealthy. You don’t need tens of thousands of naira to get started. Thanks to digital innovations like the Optimus app, you can take control of your financial future with just a small amount of money. This guide will help beginners understand how to invest in stocks and mutual funds using the app, especially if they are working with a limited budget.

N/B: Investment involve risks taking.

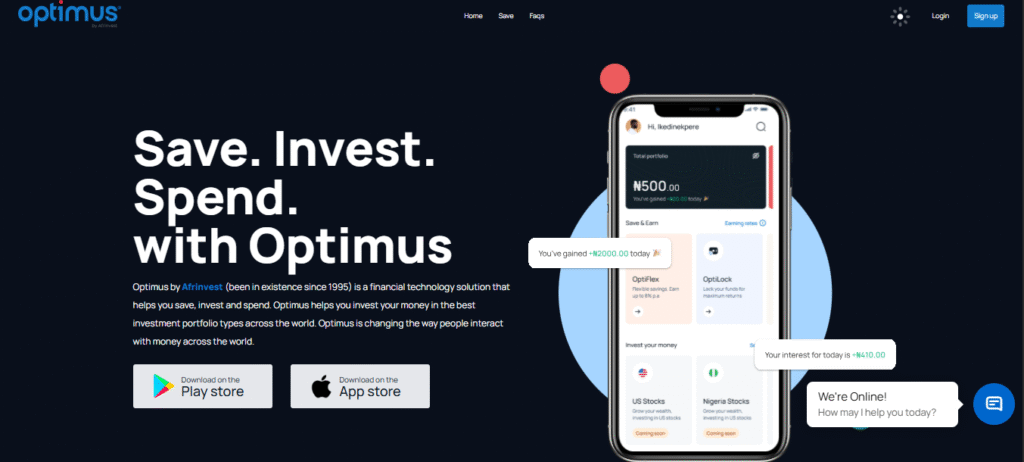

About Optimus App

Optimus by Afrinvest is a financial technology app that helps users manage their money by providing tools for saving, investing, and spending. It offers features like investment accounts (OptiFlex and OptiLock), tools for tracking payments, saving for goals, and making informed investment decisions. The app allows users to invest in mutual funds (both in Nigeria and internationally) and access US stocks. It also provides transparency about the performance of investments.

It is designed for both beginners and experienced investors who want easy access to local and international investment opportunities. Here are some of its standout features:

- US Stocks: You can invest in popular U.S. companies like Apple, Tesla, Microsoft and Amazon.

- Mutual Funds: Access a wide range of professionally managed funds in both Naira and Dollar.

- OptiFlex: Save periodically and earn competitive interest rates on your savings.

- OptiLock: Lock your money for a set period to earn even higher interest.

The app is available on both the Google Play Store and Apple App Store, and has already gained the trust of thousands of users.

How to Use the Optimus App for Buying Stocks and Mutual Funds with Less Than ₦3,000

Here’s a step-by-step guide on how to use the Optimus app to invest:

- Download the App: Install Optimus from your phone’s app store.

- Register and Verify: Sign up and complete any required KYC (Know Your Customer) processes.

- Fund Your Wallet: Use your bank card or transfer funds to your wallet in the app.

Choose Your Investment Type:

Mutual Funds: Some funds, especially Naira-based ones, allow you to start with as low as ₦1,000 or ₦2,000. For example, the Afrinvest Equity Fund is a great entry point.

US Stocks: Though some stocks are priced higher, the app allows fractional investing, meaning you can buy a small portion of a stock with what you can afford.

Place Your Investment: Select your desired investment, enter the amount, and confirm the transaction.

How to Earn Money on Optimus App

There are several ways to make money using the Optimus app:

- Stock Price Growth: When the value of your stock increases, you gain profit.

- Dividends: Some stocks and funds pay dividends regularly, which is a known way of sharing profits with investors.

- Mutual Fund Profits: The professional fund managers aim to grow your money by investing it wisely.

- High-Yield Savings: OptiFlex and OptiLock plans offer returns as high as 15% on Naira and 5% on Dollar savings, depending on the plan and duration.

How to Withdraw Your Earnings

Withdrawing your money is simple:

- Go to the Withdrawal Section: Open the app and tap on “Withdraw.”

- Select the Account: Choose the account or wallet you want to withdraw from.

- Enter Your Bank Details: Ensure they match with your registration information.

- Type in the Amount: Input the amount you want to withdraw.

- Confirm the Withdrawal: Approve the transaction and wait for the funds.

- Processing Time: Withdrawals may take a few hours to a few business days depending on your bank.

1. What can I use Optimus for, and how do I earn?

Optimus offers various investment options:

- OptiFlex: Flexible Naira or Dollar savings with daily interest.

- OptiLock: Fixed-term savings with higher returns (2 months–2 years).

- Mutual funds and US stock trading are also available within the app.

2. How can I withdraw or access my funds?

Withdrawals go directly to your registered bank account, once your KYC is fully approved.

3. Is Optimus reliable and secure?

- Pros: User-friendly, high interest rates, seamless deposits/withdrawals (for some users)

- Cons: Several users report KYC delays, slow withdrawals, app crashes, and poor customer support.

Disclaimer:

The information provided about Optimus App is for educational purposes only. We are not financial advisors, nor are we affiliated with Optimus. Investing always carries risks, including potential loss of capital.

- Investment Risks

- Returns are not guaranteed and may fluctuate

- Past performance doesn’t indicate future results

- Market conditions affect all investments

- Platform Considerations

- Optimus may change terms or fees without notice

- Technical issues could temporarily limit access

- Regulatory Compliance

- Check if Optimus is registered with SEC Nigeria

- Understand applicable taxes on earnings

- Liquidity Factors

- Withdrawals may have processing times

- Minimum balance requirements might apply

- Security Precautions

- Use strong passwords and enable 2FA

- Never share account credentials

By using Optimus App, you accept full responsibility for your investment decisions and outcomes.

Final Thoughts:

Optimus App offers Nigerian investors an accessible platform to start growing modest savings, particularly valuable in today’s digital economy where financial inclusion is expanding. For those considering investing NGN3,000 – equivalent to about $3.50 – here’s what you should know about this micro-investment opportunity:

The app’s key advantage is its low entry point, making investing possible for beginners and young professionals who might otherwise be excluded from wealth-building opportunities. Unlike traditional options requiring large capital that many Nigerians can’t spare, Optimus allows you to start small while progressively learning investment principles through its educational resources.

Potential benefits include:

- Automated investment features that simplify portfolio management

- Intuitive, user-friendly interface designed for first-time investors

- Multiple portfolio diversification options to spread risk

- Historically higher potential returns than conventional savings accounts

- Flexible contribution options to suit various income levels

However, maintaining realistic expectations is crucial. While advertised returns may seem attractive at first glance, actual earnings will vary significantly based on several factors:

- Current market performance and economic trends

- Your selected investment duration and strategy

- Prevailing economic conditions in Nigeria

- Platform fees and withdrawal charges

- Your personal risk tolerance and goals

For best results with your initial NGN3,000 investment, consider this strategic approach:

- Begin with conservative risk settings to preserve capital

- Reinvest initial earnings to benefit from compounding growth

- Monitor performance monthly while avoiding emotional decisions

- Withdraw profits only after establishing consistent growth patterns

- Gradually increase investments as you gain confidence

The platform’s long-term value proposition depends on several critical factors:

- Maintaining current regulatory compliance with financial authorities

- Sustaining competitive returns amid market fluctuations

- Providing transparent, responsive customer service

- Continuously improving security measures

- Offering relevant educational content for users

Optimus represents a modern, tech-driven approach to investing in Nigeria’s evolving financial landscape, but essential reminders include:

- It’s simply a tool, not a magic wealth solution

- Financial discipline and patience matter more than the platform itself

- Small, consistent investments systematically outperform sporadic large deposits

- Dollar-cost averaging can help mitigate market timing risks

- Financial literacy remains the ultimate differentiator

Ultimately, NGN3,000 invested wisely today through disciplined strategies could potentially grow into meaningful sums over several years. The fundamental keys remain: starting with what you have, maintaining patience during market cycles, and committing to continuous financial education in Nigeria’s dynamic economic environment.